40+ is real estate tax included in mortgage

Web Taxes on real estate can vary widely based on your state and county. Web Pros And Cons Of A 40-Year Mortgage.

Are Property Taxes Included In Mortgage Payments Sofi

Web If you include an escrow account with your mortgage payment your total monthly payment would include principal interest real estate taxes and mortgage.

. If you qualify for. Web Property taxes are collected by local governments most typically counties to pay for a variety of services. Comparisons Trusted by 55000000.

In other caseswhen loan brokers and real estate agents are involved. Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online. Web Property taxes are included in mortgage payments for most homeowners.

Keep in mind if your monthly mortgage payment includes an amount. The difference between say a 1 percent and 15 percent tax rate is huge says Tom Trott. The amount of money you borrowed.

Ad Check Your FHA Mortgage Eligibility Today. Web In some cases closing costs can be as low as 1 or 2 of the purchase price of a property. Comparisons Trusted by 55000000.

Contact a Loan Specialist to Get a Personalized FHA Loan Quote. Ad 10 Best Home Loan Lenders Compared Reviewed. Mortgage interest paid on a second residence used personally is deductible as long as the mortgage satisfies the same requirements for deductible.

Web In most cases if youâre a first-time homebuyer your lender is going to require that you pay your property taxes through your mortgage. Get Instantly Matched With Your Ideal Mortgage Lender. Web Yes and maybe.

These monthly payments do not include property taxes or homeowners insurance. Lock Your Rate Today. Web According to a report from the Urban Institute states and local governments collected 17 percent of their general revenue from property and real estate taxes in.

Lock Your Rate Today. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. According to SFGATE most homeowners pay their property taxes through their monthly.

There are two primary. The majority of revenue from property taxes are. Web If your home was assessed at 400000 and the property tax rate is 062 you would pay 2480 in property taxes 400000 x 00062 2480.

The cost of the loan. Web The traditional monthly mortgage payment calculation includes. Web As long as the real estate tax was paid you can deduct it regardless if your document shows it or not.

Ad 10 Best Home Loan Lenders Compared Reviewed. Web Your property taxes are usually included in your monthly mortgage payment though they can be paid directly At closing the buyer and seller pay for any. Get Instantly Matched With Your Ideal Mortgage Lender.

Savings Include Low Down Payment. Debts that count toward your. Web The District of Columbia imposes a deed transfer tax of 11 on residential property worth less than 400000 and 145 on property worth more than 400000.

Web For example if your monthly pre-tax income is 5000 and you have 2000 worth of monthly debt payments your DTI is 40 percent.

Mortgage Interest Deduction Homeowners Biggest Tax Perk Hgtv

What Is Escrow And How Does It Work Texas United Mortgage

Top Tax Benefits Of Home Ownership

Buying Property With A Sci In France When You Are A Foreigner What Pitfalls To Avoid Frenchentree

Home Loan For Resale Flats Eligibility Documents Tax Benefits

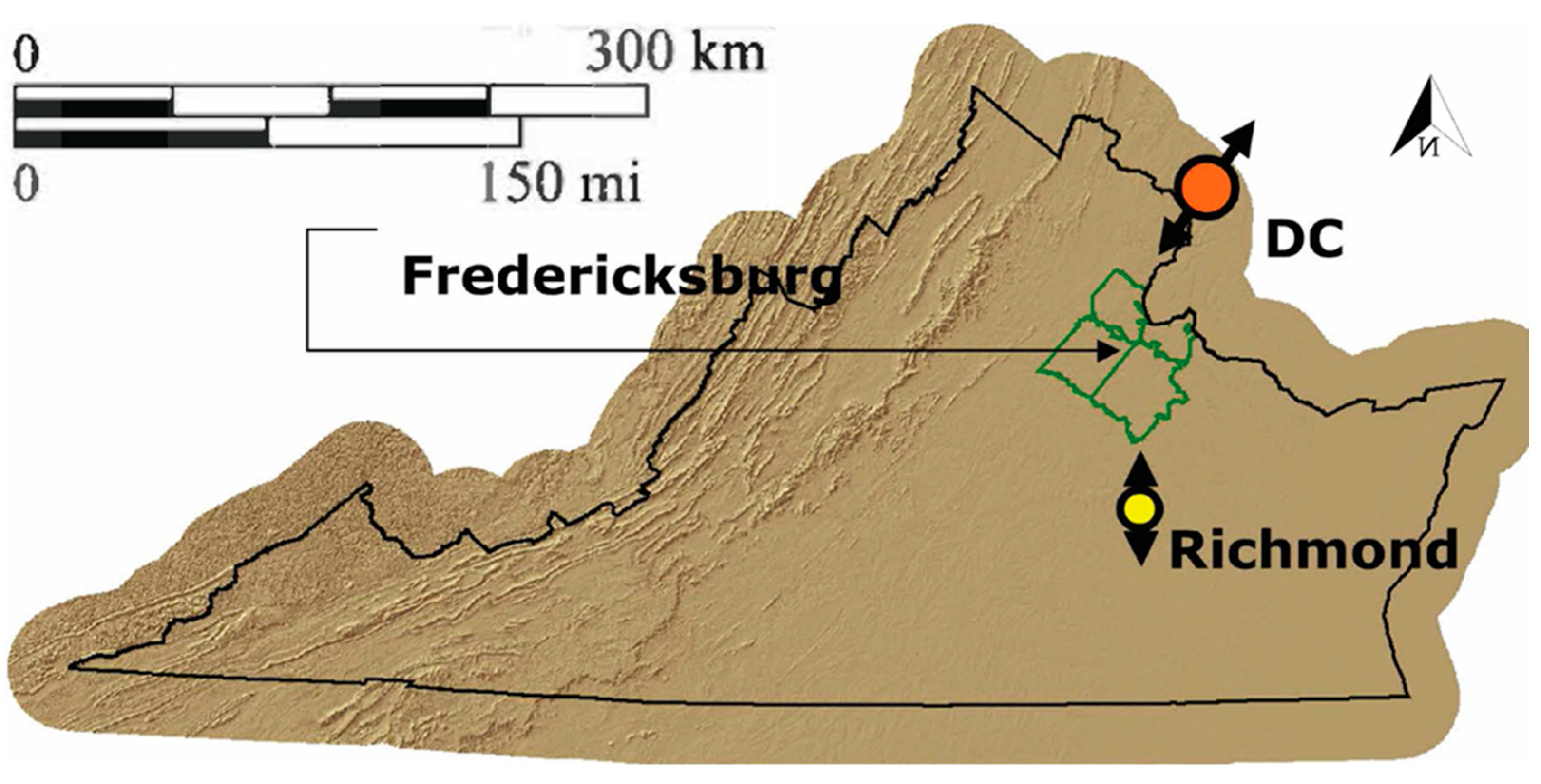

Land Free Full Text Optimal Regional Allocation Of Future Population And Employment Under Urban Boundary And Density Constraints A Spatial Interaction Modeling Approach

Canadian Mortgage App Apps On Google Play

Banks Maintain High Interest In Financing Real Estate Kpmg Czech Republic

Property Tax Explanation For Homeowners

Sindeo Shutdown Shows Why Mortgage Industry Is Hard To Disrupt

Amortization Definition Method And Examples In Accounting

Read This Before Buying Your First Home Retire By 40

40 Faqs On Auditing Auditors

119 Pender Ave Warwick Ri 02889 Mls 1327405 Trulia

Are Property Taxes Included In Mortgage Payments Sofi

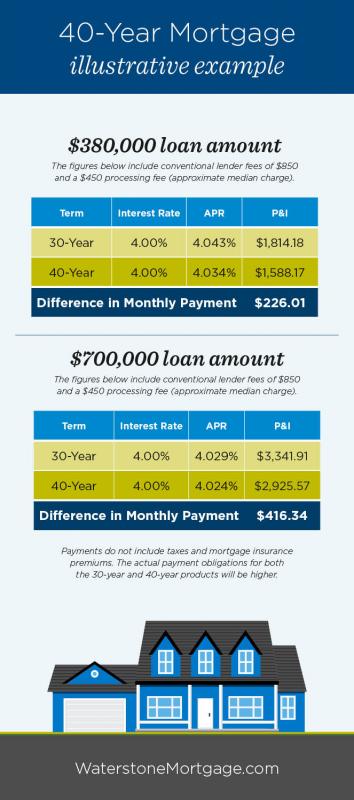

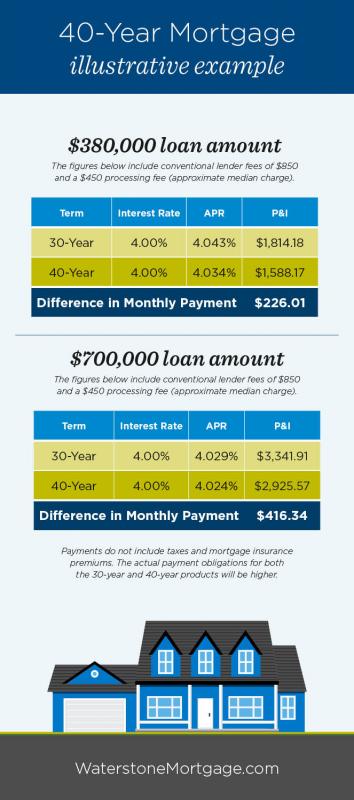

What Is A 40 Year Mortgage Cape Gazette

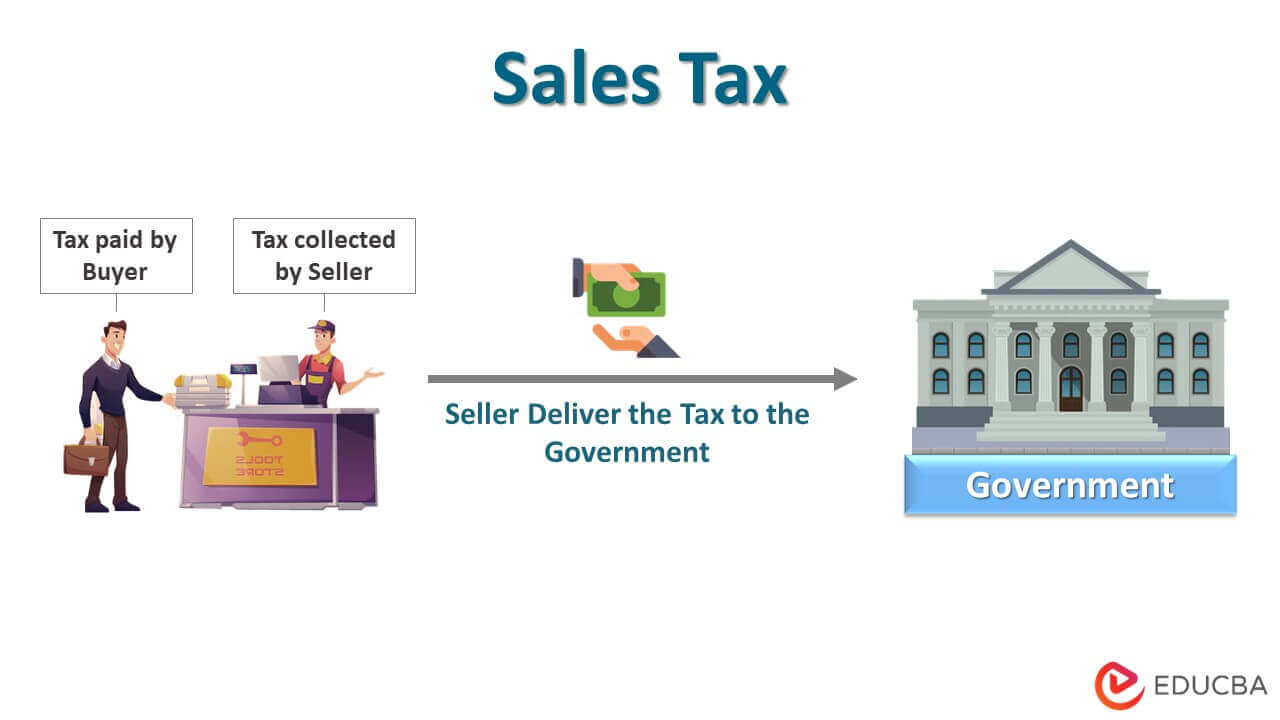

Sales Tax Types And Objectives Of Sales Tax With Examples